2008 Schedule E Instructions

You can attach your own schedules to report income or loss from any of these sources. In most cases your federal instructions for income tax will be less if you take the larger of your itemized deductions or your standard deduction.

2019 Soccer Registration Redvers Saskatchewan

Audit Instructions 2008 Inc App Internal Control Audit

Regulations Easa

Do not attach schedules k 1 to your return.

2008 schedule e instructions. General instructions each schedule e that the rental property. Your copy of schedule k 1 and its instructions will tell you where on your return to report your share of the items. If published the 2019 tax year pdf file will display the prior tax year 2018 if not.

Last year many of the federal income tax forms were published late in december with instructions. Department of the treasury internal revenue service attachment sequence no13 names shown on return your social security number. Use the same.

2008 instructions for schedule e form 1040 use schedule e form 1040 to report income or loss from rental real estate royalties supplemental partnerships s corporations estates trusts and residual interests in remics. Inst 1040 schedule e instructions for schedule e form 1040 supplemental income and loss 2009 form 1040 schedule e supplemental income and loss 2009 inst 1040 schedule e instructions for schedule e form 1040 supplemental income and loss 2008 form 1040 schedule e. 2008 schedule e instructions.

Income or loss from partnerships and s corporations. See instructions for schedule e form 1040. 2008 instructions for schedules a b form 1040 use schedule a form 1040 to figure your itemized deductions.

If you did not receive these instructions with your schedule k 1 see the instructions for form 1040 or form 1040nr for how to get tax forms instructions and publications. Schedule a if you itemize you can deduct a part of your medical and dental expenses. 2017 schedule e instructions.

1545 0074 form 1040 from rental real estate royalties partnerships s corporations estates trusts remics etc attach to form 1040 1040nr or form 1041. Schedule e form and instructions booklet are generally published in november of each year by the irs. And income or loss from grantor type trusts and non massachusetts estates or trusts are required to report income or loss from these.

2008 federal income tax forms free printable 2008 tax forms 1040ez 1040a 1040 and instructions. 2008 income tax forms for irs federal 1040ez 1040a and 1040 long form filers are available for download in pdf format free at no cost. Schedule e supplemental income and loss omb no.

Personal income taxpayers who have rental royalty and remic income or loss and farm rental income and expenses. 2019 instructions for schedule esupplemental income and loss use schedule e form 1040 or 1040 sr to report income or loss from rental real es tate royalties partnerships s corporations estates trusts and residual interests in re mics. You can attach your own schedules to report income or loss from any of these sources.

For tax years beginning on or after january 1 2008 any taxpayer with income or loss reported on a schedule e must file his or her tax return using. Instructions schedule e 2008 use schedule se form 1040 to figure the tax due on net earnings from self employ ment. 2017 schedule e form.

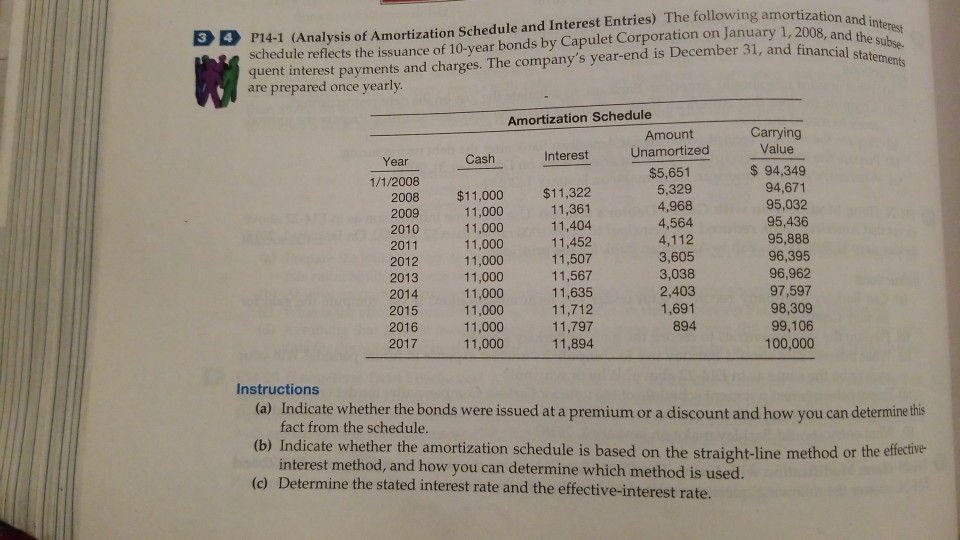

Solved 4 P14 1 Analysis Of Amortization Schedule And Int

Form 990 Wikipedia

740 Np 2008 Instructions Form 42a740 Np I

Publication 6744 Volunteer Assistor S Test Retest

Pdf Restoring Primacy In Amnesic Free Recall Evidence For

Effectiveness Of Manual Therapy In Copd A Systematic Review

Comments

Post a Comment